1099-r Reported Value of Shares

How to Read Your 1099R

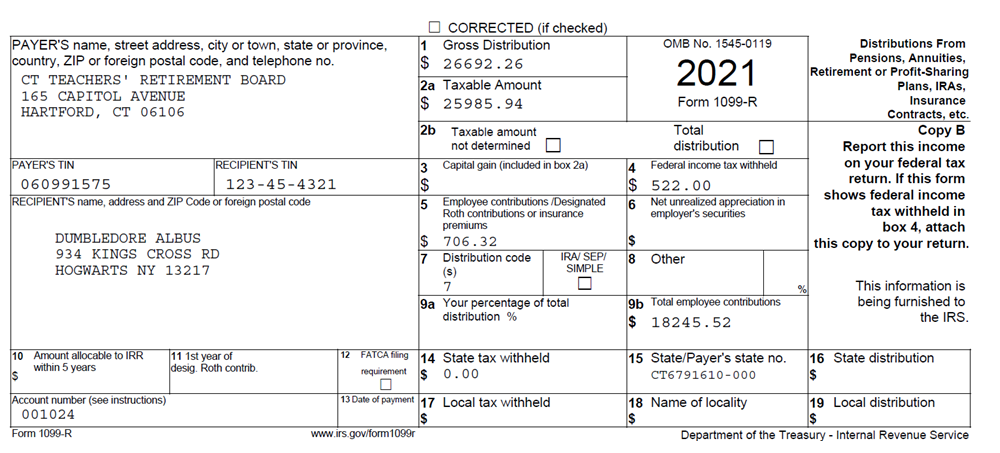

This page provides additional information you may find helpful in reading your 1099R Class.

Please annotation: The IRS has not updated whatsoever Box Fields for the 2021 taxation year

Reprints tin exist attained past submitting the Request for a Duplicate IRS 1099R Class

- Box i, Gross Distribution: This is the total distribution for the calendar year for any one type of distribution from the CTRB.

- Box 2a, Taxable Amount: This is the portion of pre-tax money of your Gross Distribution (in Box 1). Any postal service-revenue enhancement money distributed would exist represented in Box five. When combined, these 2 boxes should equal your full distribution in Box 1.

- Box 2b, Taxable amount not determined: If the "Taxable amount not determined" is checked, so the CTRB did not take all the necessary information to determine the taxable amount. In this instance, you will be required to decide the non-taxable amount yourself. You may find additional data on how to summate the non-taxable portion of your benefit in IRS Publication 575, or past referring to our Taxability of your Retirement Do good Bulletin.

- Box five, Employee contributions/Designated Roth contributions or insurance premiums: This is the portion of after-tax coin you are entitled to exclude from your Gross Distribution (in Box ane) for the calendar twelvemonth. It is equal to the difference betwixt your taxable amount (in Box 2a) and the total Gross Distribution (in Box ane). If there is an amount in Box 5, it means that when you began to receive your benefit y'all had "after-tax" money in your business relationship – money that you had already paid taxes on.

- Box vi, Net unrealized appreciate in employer'south securities: Non Applicable to CTRB

- Box 7, Distribution code(s): This IRS lawmaking represents the type of distribution you received from CTRB. Codes are listed on the back of your 1099R and a complete Guide to Distributions Codes is provided in the IRS 1099R Instructions.

- Box eight, Other: Not Applicable to CTRB

- Box 9a, Your pct of total distribution: Not Applicable to CTRB

- Box 9b, Total employee contributions: This is the full of post-taxation money in your account at the time of retirement and too known as your "investment in contract". This information is useful when reviewing the Taxability of your Retirement Benefit Bulletin.

- Box ten, Corporeality allocable to IRR within 5 years: Not Applicative to CTRB

- Box 11, ist yr of desig. Roth contrib.: Non Applicable to CTRB

- Box 12, FATCA filing requirement: Not Applicative to CTRB

- Box 13, Date of payment: Not Applicable to CTRB

Boxes 14-19. State and Local Data - These boxes are for informational purposes only and are non needed by the IRS. When filing using the original distribution mailed January 31st, 2021, please refer to the Box Titles rather than the Box Numbers.

- Box xiv, State tax withheld: This is the corporeality of CT Taxation withheld. This box does not determine your state of residence for filing.

- Box xv, State/Payer's country no.: This identification number is informational but. This box does not determine your state of residence for filing.

- Box 16, State distribution: Non Applicative to CTRB

- Box 17, Local tax withheld: Non Applicable to CTRB

- Box 18, Proper noun of locality: Non Applicable to CTRB

- Box 19, Local distribution: Not Applicable to CTRB

Source: https://portal.ct.gov/TRB/Content/Latest-News/2021/How-to-Read-Your-1099R