Can Married Couples Have Different Car Insurance in California

Our analysis found that car insurance costs $123 less annually, on average, for married drivers than for single drivers. Rates go down when you get married because insurers consider married couples more financially stable and risk-averse than unmarried drivers. We found that Progressive reduced rates the most for married couples, but State Farm offered the cheapest rates overall.

For most couples, it is cheaper to combine your car insurance into one joint policy when you're married. If one spouse has an expensive car, a poor credit score or marks on their driving record, rates on a joint insurance policy will likely be higher, but not nearly as high as if this spouse took out their own individual policy. And no matter what cars you drive or your respective credit scores and driving histories, insurers often offer a multi-car discount to policyholders who insure two cars under one policy.

We recommend that newlywed couples shop around for car insurance to get their best rates. If one spouse's driving record, credit score or car price differs significantly from the other's, we suggest getting quotes for both separate and joint policies to make sure your total costs are as low as possible.

- What companies offer the cheapest rates to married couples?

- How does marital status affect car insurance in different states?

- Auto insurance discounts for married couples

- Does your spouse have to be on your car insurance?

- Can you share car insurance without being married?

- How to combine car insurance

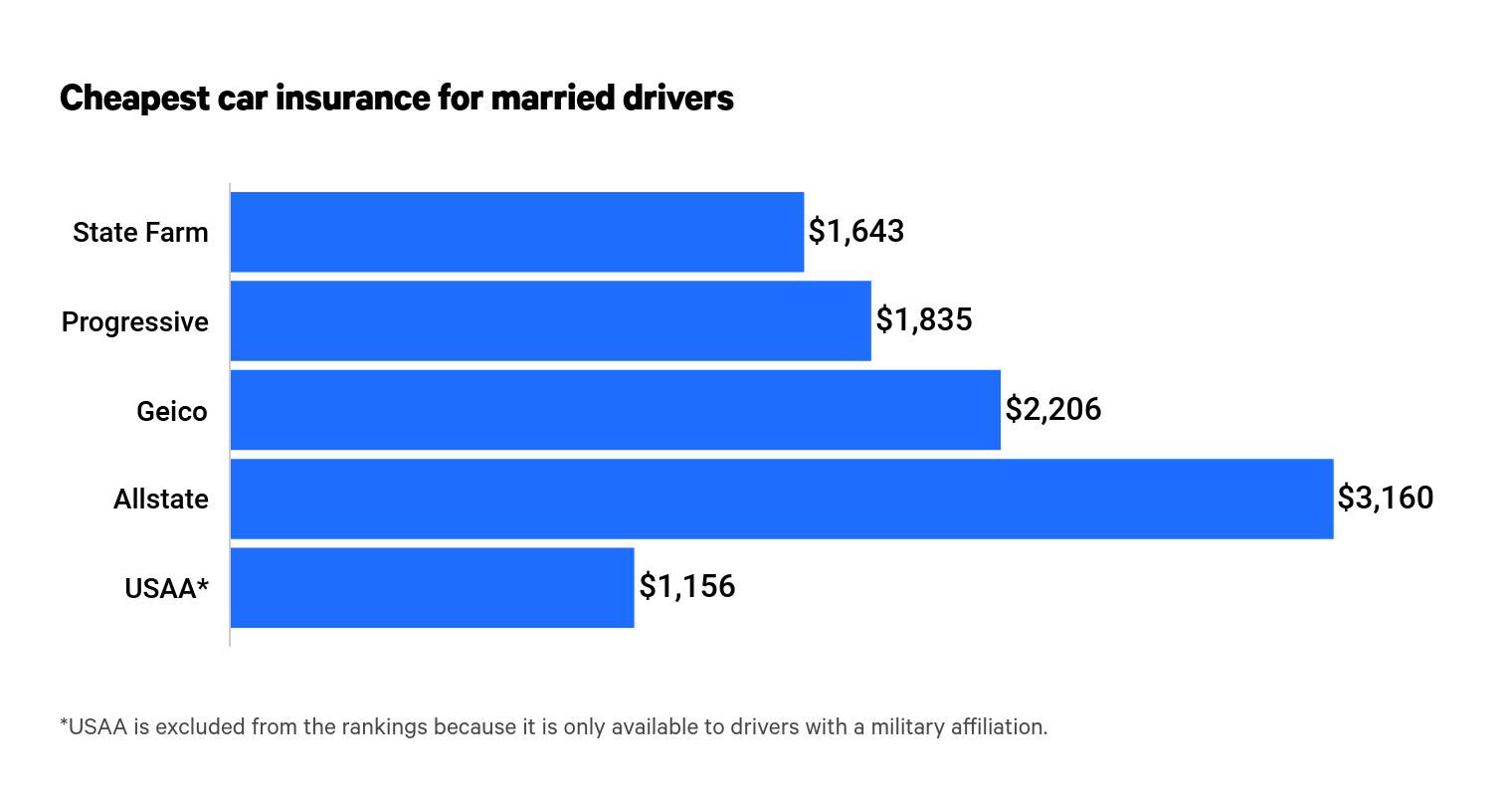

Cheapest car insurance for married couples

We compared rates from the top five largest auto insurers by market share and found that Progressive reduced rates the most for married drivers. Single drivers paid an average of $2,174 annually, but married drivers paid just $1,835, netting them 16% in savings.

However, State Farm offered married drivers the best rates overall, charging an average annual premium of $1,643 for full coverage. Yet unlike the other four insurers, State Farm's rates for married drivers were actually slightly higher than their rates for single drivers. Single drivers paid 1% less — just $1,629 per year.

If you're a married driver looking to reduce your auto insurance premiums, start your search with Progressive and State Farm.

No spam. No hassle. No hidden costs.

USAA offers even cheaper rates to current and former military members and their families. Full coverage from USAA is just $1,156 annually for married drivers, over $500 cheaper than State Farm's rates.

| Insurer | Rates for single drivers | Rates for married drivers | Difference |

|---|---|---|---|

| Progressive | $2,174 | $1,835 | -16% |

| USAA | $1,292 | $1,156 | -11% |

| Allstate | $3,270 | $3,160 | -3% |

| Geico | $2,233 | $2,206 | -1% |

| State Farm | $1,629 | $1,643 | +1% |

We collected quotes for a married male driver who is 30 years old. But by taking out a joint policy, couples can receive a multi-car discount and further reduce their car insurance rates. Read on to learn more about how couples can maximize their savings through discounts.

How does marital status affect car insurance costs in each state?

Auto insurance is cheaper when you are married than when you are single. Based on our analysis, for drivers in U.S., we found that full coverage car insurance costs $123 less annually for married couples than for single drivers — a 5% savings.

| State | Single | Married |

|---|---|---|

| Average | $2,363 | $2,240 |

| Alabama | $1,870 | $1,870 |

| Alaska | $1,576 | $1,468 |

| Arizona | $3,071 | $2,776 |

| Arkansas | $2,065 | $1,840 |

| California | $1,817 | $1,665 |

| Colorado | $3,120 | N/A |

| Connecticut | $2,753 | $2,626 |

| Delaware | $2,883 | $2,828 |

| Florida | $3,230 | $3,071 |

| Georgia | $2,386 | $2,286 |

| Hawaii | $1,763 | $1,763 |

Show All Rows

Rates are the average annual premium for a full coverage policy.

Being married affects your auto insurance rates because insurers view married couples as more financially stable and less risky to cover than single drivers, and they lower rates accordingly.

Insurers treat divorced drivers similarly to single drivers, offering both groups comparable rates. However, divorced drivers should note that credit scores may go down after a divorce, and this, in turn, might increase their auto insurance rates.

Discounts on car insurance for married couples

There is no specific car insurance discount for being married. Instead, insurers automatically factor your marital status into your rates.

However, there are many standard car insurance discounts married couples can take advantage of to lower their rates. By taking out a joint car insurance policy, which includes both cars and both drivers on one policy, married couples can score a multi-car discount. Savings from a multi-car discount are often significant; Geico, for instance, urges married couples to combine policies so they can get a 25% multi-car discount.

Additionally, married couples who own a house or rent an apartment together can get a multi-policy discount if they combine their homeowners or renters insurance with their car insurance.

Young married couples, in particular, should ask after as many car insurance discounts as possible. Although young married couples with good credit and clean records will likely pay less than their single peers, insurers charge all younger drivers higher rates because they're statistically more prone to accidents and consequently riskier to insure. By maximizing their discounts, young married couples can shave off even more from their monthly rates.

If you're married college students, for example, be sure to ask about good student discounts. And if you're confident that both you and your spouse are safe drivers, consider a telematics monitoring program that shares your data with insurers to prove you're deserving of lower rates.

Here are some other discounts that all married couples, regardless of their age, can take advantage of:

- Homeowner

- Paid-in-full

- E-bill/autopay

- Good driver

- Low-mileage

- Anti-theft device

- Anti-lock brakes

- Passive restraint

- New car

- Daytime running lights

- Signing early

- Defensive driver

- Professional and/or academic

- Military and federal employee

Does your husband or wife have to be on your car insurance?

The short answer to this is yes, almost always. Many insurers require you to list all the licensed drivers in a household on your policy — and that includes your spouse.

Fortunately, adding your spouse to your car insurance policy generally works in your favor. If you take out a joint policy that includes both spouses and both cars on it, you can snag a multi-car discount that lowers your rates.

In rare situations, however, spouses might want to consider separate car insurance policies rather than a joint policy.

Let's say you drive a 2015 Honda Civic, have a clean driving record and have a high credit score. Your spouse, by contrast, drives a Ferrari, has a handful of accidents on their record and has a lower credit score. When you combine your car insurance into a joint policy, you will likely pay far more than you did as a single driver — but your spouse, benefiting from your clean record, affordable car and higher credit score, will likely pay far less than they did as a single driver.

If your car price, credit or driving history differs significantly from your spouse's, we recommend comparing quotes from multiple insurers for both joint and single policies. Your net cost as a couple will still likely be lower on a joint policy. However, if your costs are lower for separate policies — or if, for whatever reason, you don't want your husband or wife to drive your car — excluding your spouse from your car insurance policy is the best way to go.

Excluding your spouse from your car insurance

Excluding your spouse from your car insurance means that your insurer will not provide coverage to your spouse if they drive your car. To exclude your spouse from your insurance policy, simply call your insurer and ask them to do so. This is what is known as a named-driver exclusion.

Remember, insurers generally require all licensed drivers in a household to be listed on a car insurance policy. This means that even if you and your spouse drive separate cars and take out separate policies from different companies, you would each still be expected to list the other on your respective policies — and your rates would reflect their inclusion. Named-driver exclusions allow you to work around this rule and avoid paying extra when your spouse's car, credit or record would increase your rates beyond what you're willing to pay.

Once you've excluded your spouse from your car insurance policy, you cannot allow your spouse to drive your car. If they get in an accident while driving as an excluded driver, your insurance company will not cover the damages.

Married couples should also note that not all states allow named-driver exclusions. Check your state's regulations and confer with your insurer before excluding your spouse from your policy.

Can you combine car insurance if not you're not married?

If you and your partner live together, many insurers will allow you to take out a joint policy that includes both of you and your cars. Should you decide against combining your policies, you will likely still be required to add your partner to your own car insurance policy if you share a household. By failing to list them, you risk being denied coverage if your partner gets into an accident in your car. If you don't want to list your partner on your policy, exclude them.

Be aware that while you might be able to get a multi-car or multi-policy discount as boyfriend and girlfriend or as an engaged couple, insurance companies may not lower your car insurance rates the same way they would for a married couple. Additionally, not all states recognize all kinds of partnerships (domestic, civil or common law). Ask your insurer what, if anything, these state-level regulations may mean for your rates.

How to combine car insurance with your spouse

If you've decided you want to combine car insurance with your spouse or partner, there are several steps you should take:

- Identify how much coverage you need. Your cars may have depreciated in value over the years, or your partner's car might be more expensive and need more coverage. Determine what coverage levels you need to protect yourself from legal liability and damage costs in case of an accident.

- Gather the necessary paperwork. You may want to have your newly minted marriage certificate on hand to prove to your insurer that you've tied the knot. You'll also need to collect other key information such as details about your car's make, model and mileage and proof of previous insurance coverage.

- Contact multiple insurers to compare rates. When you're comparing rates to find the best deal, we recommend talking with a human insurance agent. Agents can help you identify and include as many discounts as possible, which could in turn lower your rates. Make sure you're comparing the same levels of coverage across no fewer than three companies.

Before reaching out to insurers, we recommend having a candid conversation with your spouse or partner about their driving history, car price, credit score and previous insurance coverage. If your answers differ significantly, ask the insurance agent for rates for both separate and joint policies. While combining policies is generally the more affordable choice, it's good to check.

Methodology

The insurance rate data in this study was from Quadrant Information Services. Rates should be used solely for comparative purposes, as your own quotes may be different. Our sample driver is a 30-year-old male who drives 12,000 miles annually in a 2015 Honda Civic EX.

To calculate average annual premiums for married and unmarried drivers, we obtained and averaged rates from the top insurers in each state in terms of market share. Since rate data for married drivers in Colorado was unavailable, it is excluded from our national average calculations.

To identify the insurance companies with the cheapest rates, we used rates from the 29 states where all five major national insurers — State Farm, Geico, Progressive, Allstate and USAA — were available and had a large market share.

Can Married Couples Have Different Car Insurance in California

Source: https://www.valuepenguin.com/car-insurance-for-couples